Solution to Budget Deficit in Sight

Cap government spending until 2011, stop deflation, rely on rising tax revenues

Yutaka HARADA (Chief Economist at Daiwa Institute of Research)

It is generally believed that Japan has a huge budget deficit, that the budget deficit is our most serious and critical problem, and that we urgently need to substantially increase taxes.

The nation, however, can solve the budget deficit problem without a huge tax increase, and all that is needed is to continue restricting fiscal expenditures until 2011 and stop deflation.

Restricting fiscal expenditures until 2011 means that the government can expand fiscal expenditures after 2011 at the growth rate of nominal gross domestic product.

The reality is that, thanks to a revenue increase as a result of recovery from the so-called lost decade and the end of deflation, the worst days of Japanese fiscal deficit are in the past.

If we drastically increase taxes without considering the effects, we will be at risk of doing so excessively, leading to relaxed government spending and making fiscal restructuring more difficult.

We have to consider total revenue - at both central and local government levels - as the central government has effectively controlled local governments and is responsible for the fiscal positions of local governments under the Japanese fiscal system.

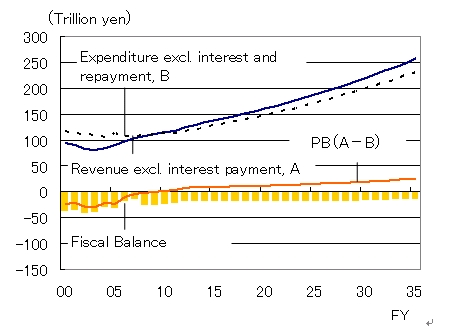

Fiscal Situation 2000-2035

Total revenue was predicted to be 94.9 trillion yen ($771.5 billion) in July 2006, and the figure in 2007 can be projected at 104.2 trillion yen if the growth rate of local tax revenues is the same as the growth rate of central tax revenues.

The government's total revenues will jump by nearly 10 trillion yen in two years, and as revenues from 1% of the consumption tax stand at 2.4 trillion yen, the government will be able to obtain tax revenues that are roughly equivalent to 4% of the consumption tax from 2006 to 2007.

Of course, such a revenue jump will not continue, since tax revenues expand rapidly during the early stage of an economic recovery. It can be assumed that after the early jump, however, revenues will increase steadily along with growth in the nominal GDP.

As for fiscal expenditure, the government's policy agenda titled Basic Policies for Economic and Fiscal Management and Structural Reform 2006 predicts that total expenditure (central and local government) will be about 113.9 trillion yen in 2011. After that, I assume that fiscal expenditure will grow at the same rate as that of nominal GDP growth.

Nominal GDP growth

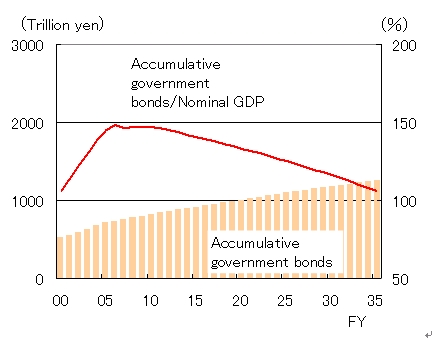

The interest rate for the long-term government bond will be equal to the growth rate of nominal GDP, and I believe the nominal GDP growth rate is 3%. If we calculate government revenue, expenditure, cumulative government bonds and nominal GDP growth until 2035, the result is that the primary balance - whereby fiscal revenue excluding borrowing covers fiscal expenditure excluding interest payments and repayments - will become positive in 2009.

The ratio of accumulative government bonds to GDP can be expected to decline from 150% in 2007 to 106% in 2035. If we predict the future fiscal position according to reasonable presumptions, Japan's situation will be greatly improved without increasing tax, while there is admittedly no room for tax reduction.

Some argue that it is irresponsible not to talk about a tax increase. However, too early and excessive tax increases weaken efforts to reduce government expenditures.

It is clear that the Japanese government was not eager to cut government capital spending because of the recent increase in tax revenue, but we can put off the debate on tax increases until we confirm the trend of tax revenue over the course of a few years. In addition, doing so will benefit fiscal restructuring in the long run.

(Originally appeared in the July 2, 2007 issue of The Nikkei Weekly, reproduced here with permission.)

|